A car allowance on the other hand is money that the. An alternative to the company car scheme company car allowance is a one-time cash lump-sum which tends to be added to an employees annual salary normally paid.

2022 Everything You Need To Know About Car Allowances

Owning a company car can be seen as a reward for loyalty.

. This is because a company car provides a huge recruiting advantage allows the organization to control its image and contributes to employee morale while avoiding the numerous hidden. It provides an alternative to. A company car allowance reimburses employees that use their personal vehicle for work.

The Advantages of a Company Car Lease. Car Allowance Personal Vehicles Instead of investing in a fleet of vehicles for their employees to use some companies allow employees to use their personal vehicles for work purposes. A company car will have all the latest safety features while an employees vehicle may not always meet these standards.

A car allowance would be more beneficial if the employee already owns a car and is in no need of an upgrade in the near foreseeable future. You need to weigh up. Company car tax is heavily weighted based on CO2 emissions with large incentives for vehicles rated at less than 50gkm which covers most plug-in hybrids and all.

20 40 45 or a super nasty marginal. Lets look at the advantages of taking a company car. The best part is the employee is investing the allowance in an asset that heshe gets in order to keep even when heshe leaves the company.

Weve listed the most common tax implications below. However if they belong to a higher taxpayer bracket. There are very specific benefits connected to providing a company car allowance.

Pros and cons of car allowance Just like. The downside to the allowance is. In the US the car allowance tax can significantly reduce the amount your employee gets to cover their vehicle expenses even by 30-40.

Car allowances cost you AND your employees money and decrease productivity. When tax season comes around opting to use a car allowance will cost you more money too. From low benefit in kind BiK tax rates to the liberty of making financial agreements having a company car can bring multiple.

For the most part the firm will cover the vast majority of your driving costs many companies even offer a private fuel. They can choose the best car to suit their needs while. Company cars may be best when solely used for business whereas a car allowance may be more suitable for those who will use the car privately too.

The answer to the question. And in most cases company-provided vehicles are better maintained. Which one is better company car or car allowance is neither.

The IRS sees car allowances as a form of compensation rather than a. Most businesses give employees an auto allowance to reimburse them for the expense of driving a company car for business. You Can Give Employees an Auto Allowance.

Company car vs car allowance Overall choosing a cash allowance is the more flexible option since this cash can be used for a variety of purposes or to finance your dream vehicle. The bottom line is there is no right or wrong answer. Company cars may be reserved for business purposes or given to employees for both personal and business use.

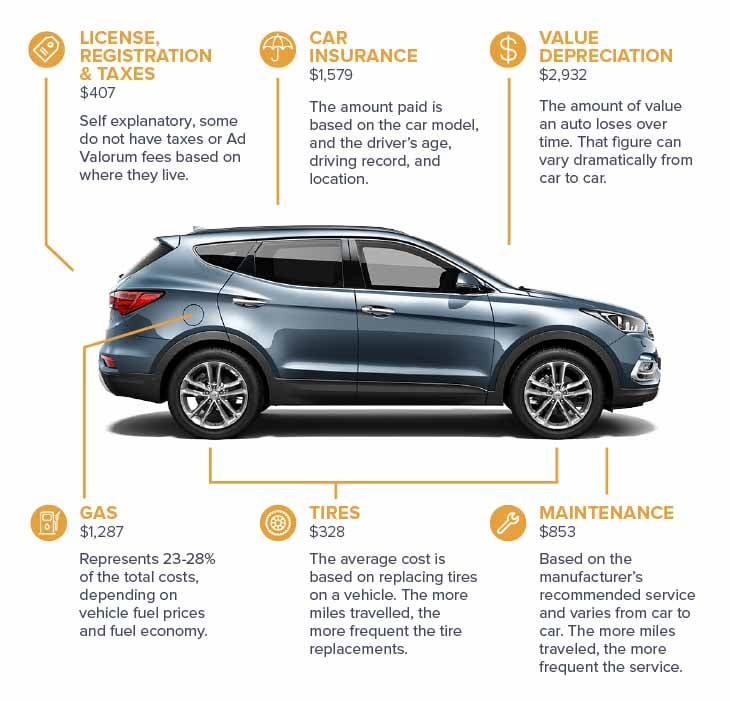

Costs include wear and tear fuel and other expenses that they incur. A company car on the other hand is a vehicle. If your company is looking to implement a vehicle program that promises fairness and.

Car allowance as the title suggests is when a cash sum is added on top of an employees annual salary so they can afford to buy or lease a car. To calculate the BIK tax multiply the P11D value by the BIK percentage banding then multiply that figure by your top rate of tax - ie. However if you want your employees to have more freedom and the ability to save money a car allowance is your best bet.

Ad Learn why car allowance is taxable how you can create a fair vehicle program with Motus. Whether you opt for company cars or car allowance all depends on what works best for your business. Car allowances cost you AND your employees money and decrease productivity.

Ad Learn why car allowance is taxable how you can create a fair vehicle program with Motus.

Company Car Or Car Allowance Which Is Better Moneyshake

2022 Everything You Need To Know About Car Allowances

Allowance Vs Cent Per Mile Reimbursement Which Is Better

New Company Car Allowance Policy Template Policy Template Policies Templates

0 Comments